Parts I, II, III and IV of the Holding Islands Hostage series have extensively discussed the impact of an exclusive telecommunications licence in the Falklands

Part V of this series delves into a murky world of secrecy, closed doors, commercial confidentiality, and redacted documents. This post examines the opaque financial position of Sure South Atlantic and its Falkland Islands operations, in light of the company’s claims that it may not survive the introduction of Starlink. I wrote a previous email focusing on this subject: ‘Sure Warns of Profit Loss as Starlink Lands in the Falklands at the end of March 2025. Please review this before jumping into Part V.

As Sure refused to provide detailed financial data to the VSAT Select Committee, to the best of my knowledge, this prompted the need for an independent analysis using publicly available figures, historical accounts, and estimated revenue splits.

Key findings include:

-

Estimated revenue for Sure Falkland Islands in 2022 was £11.1 million, with a pre-tax profit of £4.1 million, indicating a robust profit margin.

-

Over the last decade, revenue and profits have remained strong despite rising costs.

-

Estimated broadband data revenues may fall back by up to £2 million due to Starlink, representing a 20% reduction, rather than an existential threat.

-

Two substantial dividend payments of around £8.5m to Batelco in ’22’ and ’23.

- Sure’s statements about being unable to survive Starlink competition appear inconsistent with these financial patterns.

While the numbers used in this analysis involve conjecture due to limited public disclosure, they suggest Sure Falkland Islands is far from a financially vulnerable entity. The real mystery remains: Why won’t Sure share the facts?

Caveat: I am not an accountant, and the figures presented in this post are based on publicly available data, estimates, and informed guesswork. While every effort has been made to ensure the analysis is reasonable, the absence of full financial transparency from Sure means that some assumptions will be inaccurate, incomplete or plain wrong. These calculations should be viewed as illustrative rather than definitive.

Estimate of Sure Falkland Island revenues

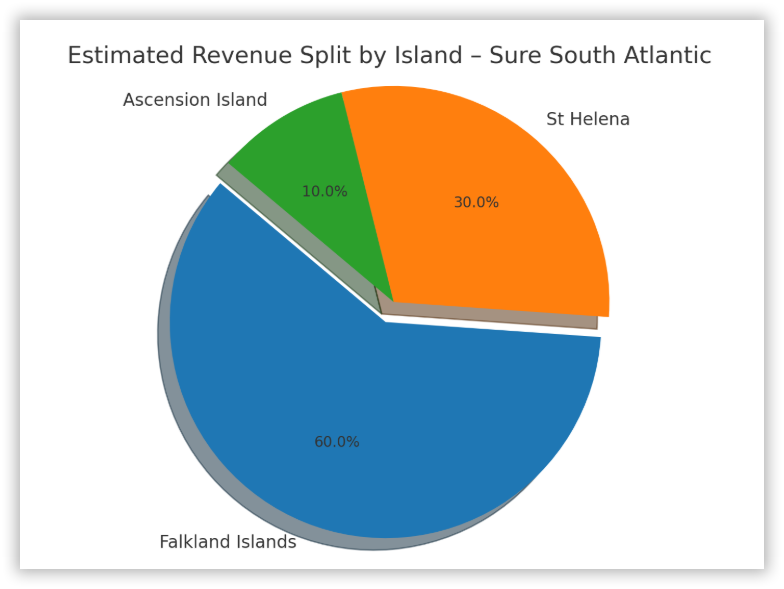

Sure South Atlantic operates telecommunications services across three remote British territories: the Falkland Islands, St Helena, and Ascension Island. While specific financial breakdowns by island are not publicly available, we can estimate the revenue distribution based on population size, economic activity, and likely telecom usage patterns.

The Falkland Islands are likely the most significant contributor to Sure South Atlantic’s revenue, accounting for an estimated 60%. Despite having a population of just under 4,000, the Falklands have a more developed economy, a significant presence of UK military operations, and a higher per capita demand for telecom services. This economic and infrastructure profile makes it the most commercially viable market in the region.

St Helena, with a population of around 4,500, is estimated to contribute about 30% of the revenue. Although less economically developed than the Falklands, the island has seen an increase in digital activity following the opening of its airport and the arrival of the subsea Google Equiano cable. Government services, a modest rise in tourism, and remote working have also contributed to the growing demand for telecom services, particularly in broadband and mobile services.

Ascension Island, with fewer than 1,000 residents, primarily military and government personnel, is estimated to generate the remaining 10% of revenue. Although civilian telecom demand is minimal, the island is likely to host several high-value contracts with the UK and US government agencies, which may support more advanced and secure communications infrastructure.

Overall, this distribution, comprising 60% from the Falklands, 30% from St Helena, and 10% from Ascension Island, provides a reasonable approximation of how Sure South Atlantic’s revenue might be split across its three South Atlantic operating regions. To keep things simple, we will use these percentages in our calculations, even though it is likely that there could be significant variation in P&L costs between the islands.

Sure South Atlantic P&L summary

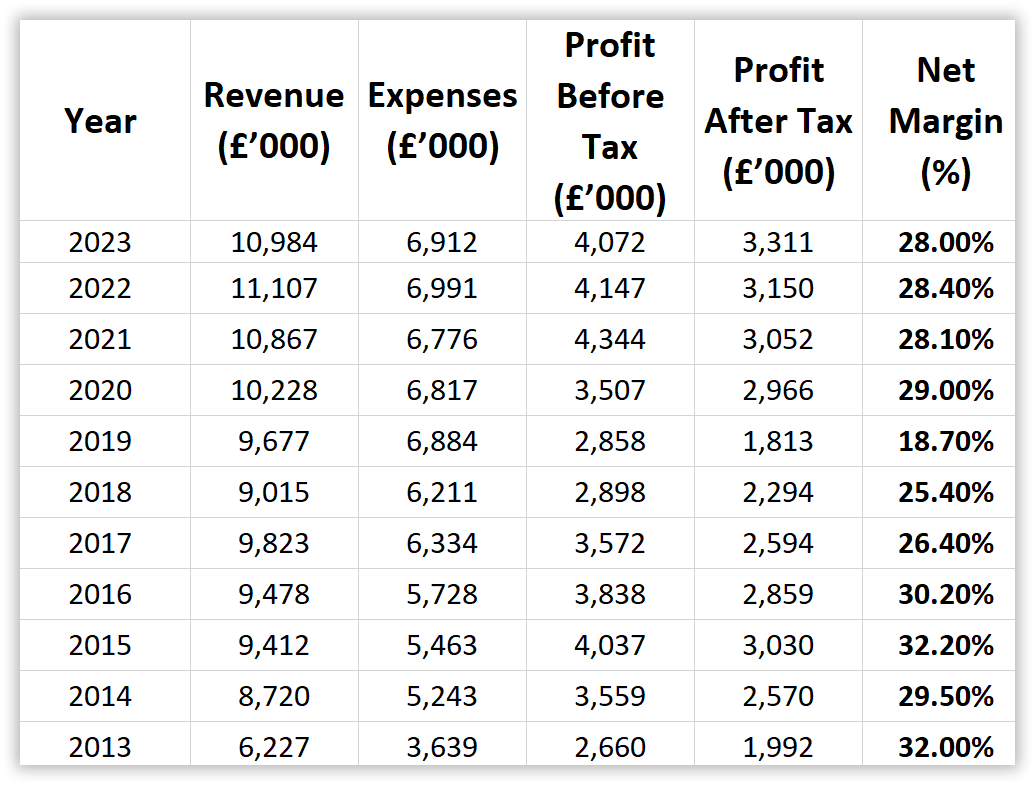

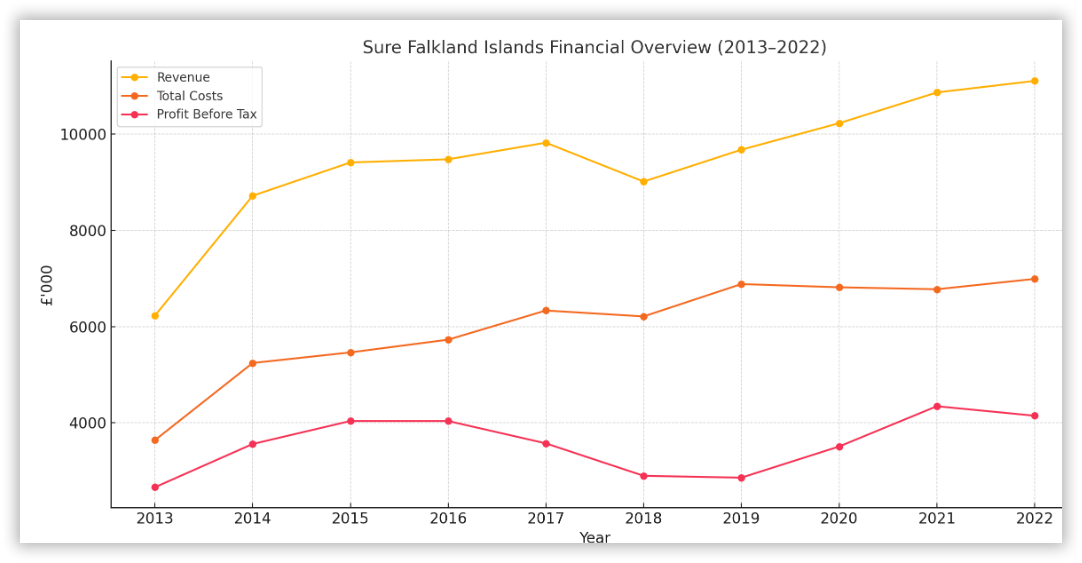

As mentioned above, these figures represent an aggregated view of the profit and loss (P&L) statement for the three islands. The annual company account filings are held in the Falkland Islands Government’s (FIG) registry and can be obtained from there, subject to a Registry fee for each document. The image below shows the P&L for Sure South Atlantic for the years 2013 to 2022. The figures for 2023 are now available.

PDF version of P&L summary

Sure annual accounts summary 2013 to 2022Download the PDF.

One of the most interesting line items is the one showing the dividends distributed to shareholders. Since Beyon (Batelco) is the sole owner, dividend payments would go directly to them.

Here are the dividends paid each year these are not insignificant amounts when compared to profits:

Note: £8.5m would go a long way to upgrading Stanley’s antiquated VDSL broadband infrastructure! Although I’m moving on to my next post, it is worthwhile noting that an estimated industry cost of upgrading Stanley’s fibre infrastructure (say 2,000 homes) would be £1m – £2.4m for aerial fibre distribution (on telephone poles) or £2.4m – £5m for underground fibre distribution.

Sure Falkland Islands Estimated P&L (2013–2022)

Using the estimate that 60% of Sure South Atlantic Accounts equate to Sure Falkland Islands, here are the estimated financials for the Falklands:

All figures below are estimates based on 60% of Sure South Atlantic’s accounts (in £’000).

-

Revenue Growth: Revenue has grown steadily from £6.2m in 2013 to over £11.1m in 2022, showing strong long-term growth.

-

Consistent Profitability: Profit before tax remains strong, generally between £2.6m–£4.3m, despite cost increases.

-

Rising Costs: Total operating costs have also increased from £3.6m in 2013 to nearly £7m in 2022 but revenue growth has outpaced them.

Are these profit levels reasonable?

Based on both research and my experience, net profit margins of 3% to 10% are typical for small telecom operators, while mid-sized operators usually report margins in the 5% to 12% range. Telecommunications are now considered a commodity business after all.

In this context, Sure’s average net margins of 29% appear unusually high. Combined with the substantial dividend payouts, it reinforces the impression that Sure may be operating as a monopoly ‘cash cow’ for Beyon (Batelco). A cash cow is a business, product, or division that consistently generates high levels of cash flow or profit with relatively low ongoing investment or operational cost.

By the way, Sure Falkland Islands’ contribution to Beyon’s £884 million in 2023 revenue is negligible – just 0.012% of the total.

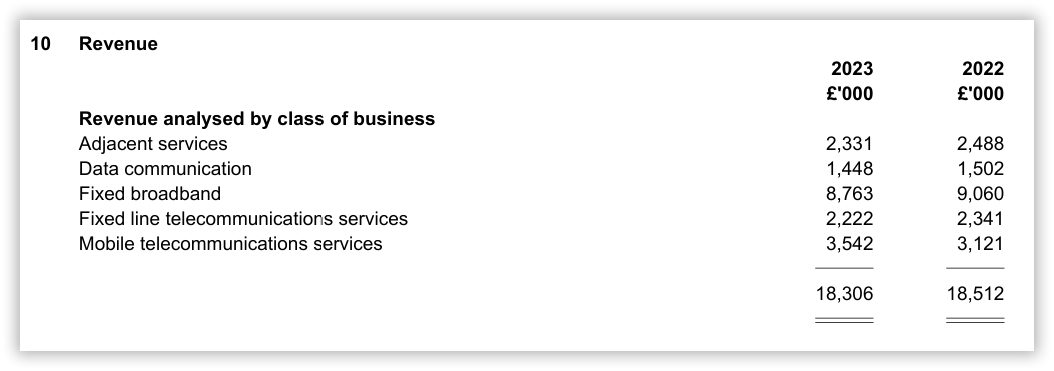

Sure’s Service revenues.

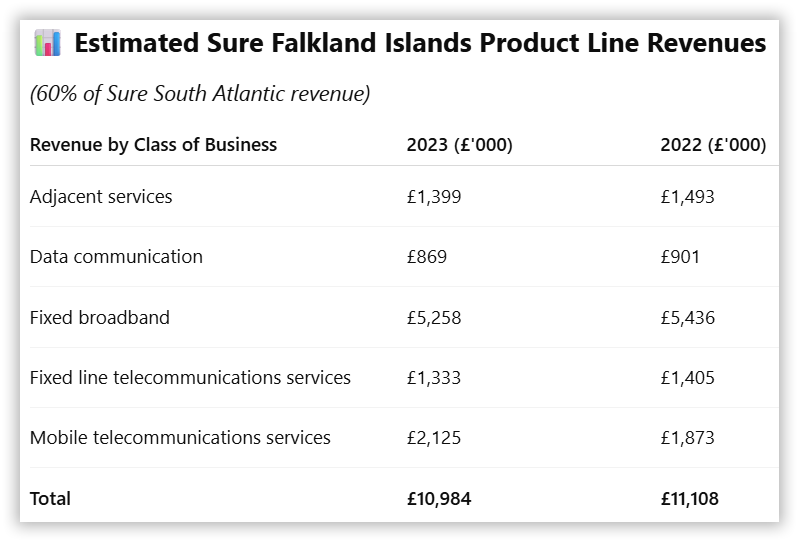

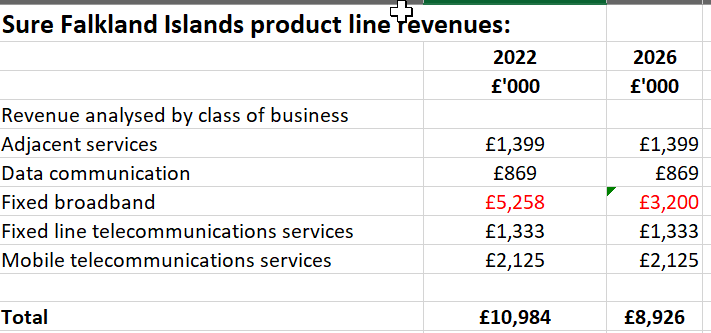

Now that we have an estimate of the revenues that can be allocated to Sure Falkland Islands (Sure), the following data from the 2023 Sure South Atlantic P&L allows us to calculate the estimated product line revenues for the Falklands as well.

Sure South Atlantic Service revenues

Note: “adjacent services” refers to revenues from offerings that are not part of the company’s core business, but are closely related or complementary to it. It could be conjectured that these numbers would not be affected by Starlink approval.

Sure Falkland Islands Service revenues

Again, using the 60% estimation, Falklands’ service revenues can be calculated:

Sure Falkland Islands estimated total data service revenue is £869m + £5,258m = £6,127m

How will Starlink impact Sure’s P&L?

What we would like to conjecture/estimate/guess is what the impact of the widespread use of Starlink in the Falkland Islands would be on Sure’s P&L

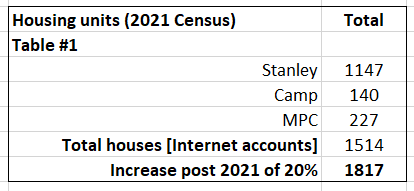

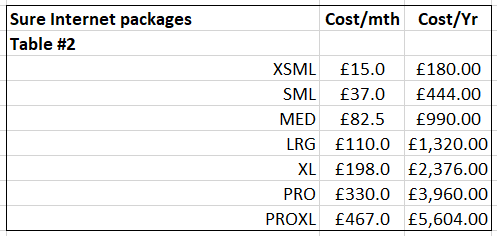

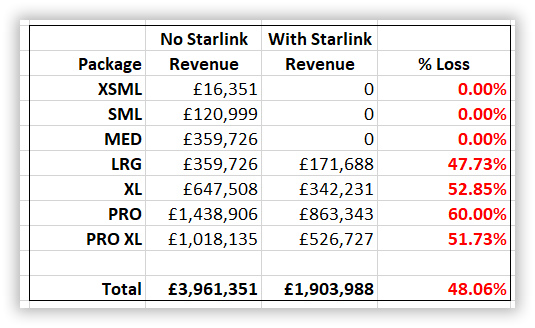

Table #1 and Table #2 show the number of houses that could have a Sure broadband account and the current costs of Sure’s broadband packages (ignoring the new unlimited packages).

Caveat: It’s a realistic assumption that every dwelling place has a Sure broadband account.

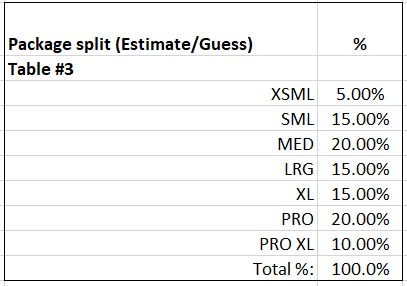

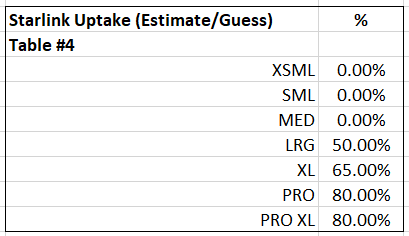

Table #3 is an estimate/guess of the number of broadband users using each package. Table #4 represents the estimated % of users who could reasonably migrate to using Starlink.

What-if analysis of the spreadsheet indicates that marginally adjusting these percentages does not significantly impact the results.

Using the above figures, Table #5 estimates or guesses that the total revenue derived from broadband services based on housing units before the use of Starlink, could be nearly £4m with a high take-up of 80% of larger packages migrating to Starlink, Sure’s broadband revenue could drop to just under £2m showing a overall financial hit of 48%.

Caveats:

- Countless variations of numbers could be used in the calculations, and it is impossible to attempt to calculate all possibilities, requiring a significant amount of effort.

- The calculation assumes that everyone who uses Starlink would drop back to using Sure’s MED broadband package for backup purposes.

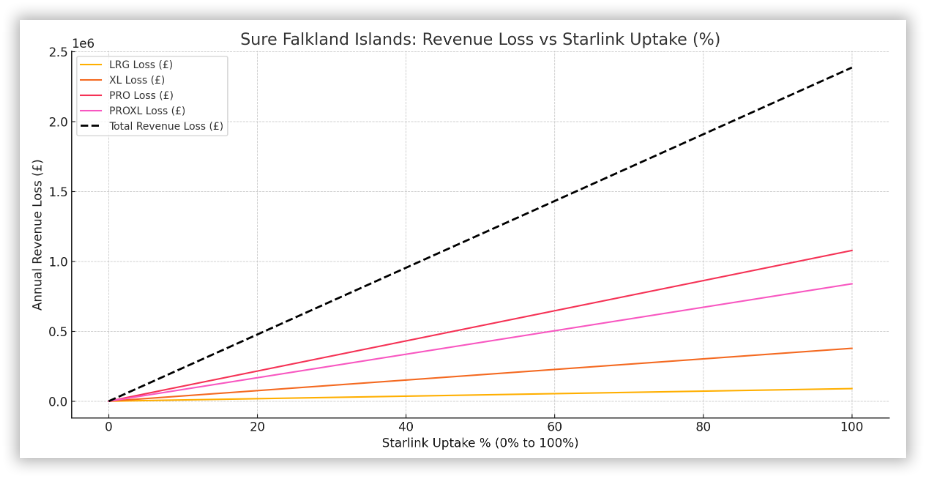

Further calculations using 0 to 100% Whatif numbers for users changing to Starlink, as shown in Table #4 are shown in the following graph:

Worst case, Sure will lose just under £2.5m if 100% of users switch from the higher cost packages to the MED package.

Quick Analysis of the Calculations

These calculations have been undertaken solely for the fun and challenge of doing so and should not be used as any guide to Sure’s profitability – or lack of it – in any way.

Data revenues

First, Sure Falkland Islands estimated total data revenue is £6,127 million, as derived from Sure’s audited profit and loss statement (P&L) for 2023. Second, using a bottom-up calculation based on the number of houses with a broadband account, the Sure has a total broadband revenue of £ 3,96 m. These totals differ by £2,966; so, what is the reason for this difference?

Sure has additional revenue sources, including FIG’s intranet contract, FIG’s satellite capacity support to Sure of over £1m per annum, first approved in September 2019 and later extended in July 2022 for a further three years, business contracts, and contracts with MPC. The October 2024 MPC MOD contract had a total value of £3.7m, and the January 6, 2025, BFSAI Enhanced Business Broadband Phase 2 contract had a value of £1.43m.

The key point to note is that Starlink operations will not impact these additional revenue streams as listed in the P&L.

Impact of Starlink on the totality of Sure revenues

What is the impact of the guessed £2m loss of revenue due to the use of Starlink on the guessed overall 2026 numbers?

These calculations suggest that deploying Starlink in the islands would lead to an overall financial loss for Sure of approximately 20%. Though notable, this level of loss is likely manageable for most companies. So, why is Sure insisting that Starlink would ‘break’ their profitability to a point where their business is unsustainable?

Morgan Stanley forecasts that Starlink revenue could reach a stunning US$48 billion by 2030 and that telcos worldwide will stand to lose tens of billions in global broadband revenue, particularly in underserved and rural segments. The precise impact varies by market, but rural-focused providers may experience potentially severe revenue declines of tens of per cent. This forecast aligns nicely with the calculations presented in this post.

Sure’s views on profitability.

I wrote a previous email focusing on this subject: ‘Sure Warns of Profit Loss as Starlink Lands in the Falklands at the end of March 2025.’

As a reminder of some of the comments made in the March presentations or in Sure’s submission to the VSAT Select Committee.

Q: “Could you publish that information, though, the profits, so we can make a decision from that? A: “No, I can’t share that information with you right here and now. But the point is that if the Falkland Islands cannot sustain two, three, four operators, it’s just simply not big enough.”

“…we’ve got our costs in terms of the people that we employ here, we’ve got our costs in terms of the capacity that we’re spending millions of pounds on, and we can’t overnight cut those costs to zero. That’s not how it works. And if we want to be able to provide those services in an ongoing way, supported with a local team, it requires very significant investment to be able to do that. And there isn’t room in the market for two operators.”

“It is our view that should there be an increase in VSAT licenses in the islands and or the licensing of Starlink, it will seriously undermine our ability to do this.”

“…if Starlink was to come across, come into all of our islands, yes, we would not make any profit.”

Are the calculations undertaken in this post so dramatically wrong that this stance can be justified? As far as I know, in July 2025, Sure have still not provided FIG with any substantive financial data to justify their extreme statements made in the March presentations.

Even though the calculations made in this post are only estimates, barely better than guesses, I find it hard to believe or understand those statements have any veracity in practice. However, I can only leave it to readers to form their own opinions.

Conclusions

Sadly, the deeper you dive into Sure’s financials, the murkier the waters seem to become. What should be a straightforward examination of company performance, especially when public policy and national infrastructure are at stake, turns instead into an exercise in extrapolation, approximation, and educated guesswork.

While Sure South Atlantic refuses to publish financial data specific to the Falklands, the numbers we can estimate tell a very different story from the doom-laden messaging issued earlier this year by Sure South Atlantic’s CEO. Based on published profit and loss statements (P&Ls), Sure Falkland Islands has experienced steady revenue growth, consistent profitability, and strong operating margins for nearly a decade.

Even accounting for potential broadband revenue loss due to Starlink operation, estimated at up to £2 million annually, this represents only an estimated 20% hit to total revenues. Any well-managed company with healthy historical profits and a monopolistic position should, in theory, be able to weather such a storm, especially one that plays out gradually, not overnight.

And yet, instead of engaging in honest dialogue or being transparent with the public and FIG, Sure has opted for silence and sweeping claims of impending collapse.

This lack of transparency is troubling, not only for what it reveals about Sure’s attitude toward public accountability, but also for the precedent it sets. When a single telecoms provider has outsized control over digital infrastructure with no obligation to justify its actions or statements, the community loses more than just bandwidth. It loses trust.

This post does not claim to provide definitive answers. The numbers are best-guess estimates based on limited public data, cross-checked and reverse-engineered from filings and assumptions. But they do serve one purpose clearly: they challenge the narrative that the Falkland Islands are on the brink of financial ruin. If the company wants to be taken seriously in its warnings, it must start by doing something radical: sharing the facts.

The situation has changed markedly. The success of the Starlink Petition Group has shown that grassroots action and democratic engagement can lead to meaningful change. May that momentum continue!

One final thought-provoking calculation: If Sure Falkland Islands had functioned as a non-profit government entity with no need to make dividend payments from 2013 to 2023, approximately £25,000,000 might have been reinvested directly into the islands’ telecommunications infrastructure. A significant opportunity, in hindsight.

Now that’s a figure worth reflecting on.

Chris Gare, OpenFalklands July 2025, copyright OpenFalklands

Sure have given notice to quit on Ascension. They say they will pull out (although not sure of what) in February 2026 because of losing the monopoly.

The sure.co.ac web site has a banner announcement of it linking to a PDF but their web server does not deliver it – instead it redirects to home page.

Ascension Island Facebook group has a copy of it.

See our next post for a discussion about this press releae.

Some of you who visit this site may recall that I advised the FIG on policy relating to licence renewals for then C&W during the early to mid-2000s. I also advised on the need for and the setting of a regulatory price cap. Having privileged sight of company financials, I calculated and recommended new lower tariffs that allowed the monopolist to enjoy a fair return on its employed capital and more importantly safeguarded consumers from monopoly abuse. It’s now 2025 and the wheel of fortune has turned around to the same question – but the elephant in the room is Starlink. Back in the 2000s it was VSAT access that irked C&W. Today it’s Starlink that irks Sure. The questions remain the same: it’s a case of Back to the Future!

So where are we? Chris Gare has done his best with public information to suggest Sure is profitable, has been profitable and will likely remain profitable notwithstanding Starlink. In other words, even allowing for some customers to pay an annual licence fee of £180 for a VSAT terminal and use Starlink, Sure in his opinion can still maintain its operations profitably. Of course, Sure might contend otherwise, but as far as I am aware they have not presented a case that can be forensically scrutinised in public.

But let’s address the elephant in the room. For decades the Falkland Islands has had a statutory monopoly (first C&W, then Sure owned by Batelco) supplying services. No one disputes the services are essential (indeed, in the UK they would probably be designated critical national infrastructure under new legislation). Controversy surrounds the terms made available for the services offered, and the quality of service provided. In regard of the former, the perennial question is: Is Sure earning a fair return or an excessive return? Meaning are prices fair or too high? In some respects, this is the easier question to address – if they are too high FIG possesses the means to address the problem: price regulation.

But what about service quality? In considering the issue of a new licence, FIG has an opportunity to consider licence obligations that are fit for purpose, future proof (at last over ten years) and fair. In this respect, I contend we need to ask: is it sensible to have a Falkland Islands that has a two-tier population: the have Starlinks and the have-nots. I propose that FIG considers applying an obligation that requires any future licensee to offer community access to Starlink. Why on earth waste the current local infrastructure and have multiple VSATs in Stanley? Let me explain further.

There are several telcos around the world who have signed agreements with Starlink to use large community gateways (Nauru Telecom in the Pacific, OptimERA xG in Unalaska, Alaska, Kativik Regional Government (Northern Canada), FSM Telecom, Micronesia). How does it work? The satellite signals land via a large Ka-band earth station (the kind Sure already have) for around £60,000 per Gbps pm. The signal can then be distributed on the terrestrial and wireless networks deployed by Sure – pretty much the model it uses with its current access provider Intelsat on C-band. Incidentally, the cost of the data connection on Intelsat is around the same or more than Starlink’s community gateway model.

Distributing Starlink’s signal can reach speeds of 10 Gbps, the connection can be symmetrical and it far exceeds what is offered through the Intelsat system used by Sure. Latency on Starlink is less than 100ms, versus around 300ms on Intelsat. So all in the Starlink service is far superior.

So what’s to lose? FIG should mandate that the new licensee signs a community gateway deal with Starlink. Falkland Islanders would get a far superior service, for the benefit of all and especially those in business and government. Costs are unlikely to differ much. There is no need for a proliferation of VSATs in Stanley – service can be distributed on overhead fibre using existing poles.

Most of Sure’s physical access assets in the Falkland Islands can be used in a Starlink community gateway model managed and distributed by the exclusive licensee. Regulation can ensure fair prices. If Sure claims its copper network would need to be written off; good. It’s been written off all over the world as telcos salvage the copper for scrap! Much of it has been there for decades and should be written off.

It’s time to let the future move on and let Falkland Islanders enjoy a quantum leap in Internet experience: health, education, leisure, business and government will all benefit and the economy of the Falkland Islands will be stronger as a consequence. From gamers to medics, home workers to tourists, government workers to private businesses, the future is not orange (for those who remember the strapline), it’s Starlink through a community gateway!

We hear a lot of companies go on and on about being transparent but when it comes to it they are not, it gets so predictable